Where there’s smoke, there’s subrogation. At least it often works out that way. The adage is certainly true in the case of Gree dehumidifiers. If you have anything to do with property insurance, you have likely been exposed to multiple claims involving Gree dehumidifiers. It took 450 fires and nearly $20 million in property damage, but on September 12, 2013, Gree, along with the U.S. Consumer Product Safety Commission (“CPSC”), announced a recall on dehumidifiers manufactured and sold in the U.S. from January 2005 through August 2013. On November 29, 2016, Gree and the CPSC reissued the recall, leaving no doubt that there was a lot of subrogation dollars to be realized with regard to this faulty product. The 3.4 million Gree dehumidifiers subject to the recall overheat, produce smoke, and then catch fire. A video showing the dehumidifier bursting into flames can be viewed HERE. But, it is the story behind the story that makes this particular product defect so tragic.

Where there’s smoke, there’s subrogation. At least it often works out that way. The adage is certainly true in the case of Gree dehumidifiers. If you have anything to do with property insurance, you have likely been exposed to multiple claims involving Gree dehumidifiers. It took 450 fires and nearly $20 million in property damage, but on September 12, 2013, Gree, along with the U.S. Consumer Product Safety Commission (“CPSC”), announced a recall on dehumidifiers manufactured and sold in the U.S. from January 2005 through August 2013. On November 29, 2016, Gree and the CPSC reissued the recall, leaving no doubt that there was a lot of subrogation dollars to be realized with regard to this faulty product. The 3.4 million Gree dehumidifiers subject to the recall overheat, produce smoke, and then catch fire. A video showing the dehumidifier bursting into flames can be viewed HERE. But, it is the story behind the story that makes this particular product defect so tragic.

Gree Electric Appliances Inc. of Zhuhai (“Gree”) is a Chinese global air conditioner and dehumidifier manufacturing powerhouse, boasting 80,000 employees worldwide and $22 billion in annual air conditioner sales. Gree is approximately the same size as U.S. manufacturer Whirlpool Corporation in terms of employees. Gree has become infamous for its astonishing series of alleged fundamental mistakes in addressing what should have been a simple-enough (albeit serious) dehumidifier recall.

The Gree story reads more like a Grisham novel than real life. In this article, we will trace the steps of this incredible saga. Along the way, we will uncover a lawsuit for intentionally attempting to ruin a joint venture with a partner company, an alleged failed Watergate-like cover-up attempt, the largest fine ever levied by the CPSC, a $20 million punitive damages judgment, countless individual claims against the company, and a class action filed in California related to design defects allegedly affecting the Gree dehumidifiers.

THE SAGA BEGINS

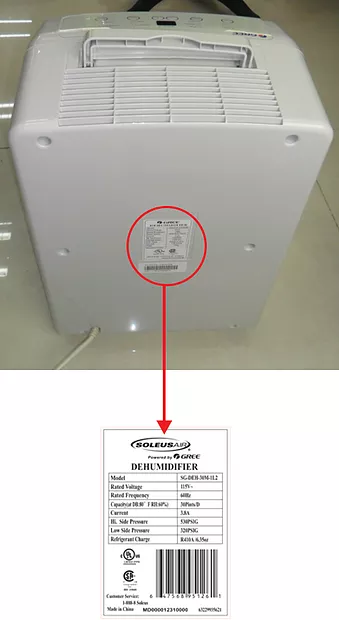

Most claims professionals and subrogation lawyers are already familiar with Gree products. Gree manufactured and sold dehumidifiers under 13 different brand names, including Danby, DeLonghi, Fedders, Frigidaire, GE, Gree, Kenmore, and Soleus Air. They were sold at nearly all of the big box home improvement stores – Menards, Lowe’s, Sears, etc. – as well as online. On October 30, 2010, Gree and a California-based company named MJC America, Inc. (“MJC”) entered into an agreement to leverage their relative strengths in order to sell in America dehumidifiers built in China. Gree’s design and manufacturing expertise and MJC’s relationships with big box retailers seemed to be the perfect marriage. They formed a joint venture known as “Gree U.S.A.” which saw explosive growth and enjoyed remarkable success for the first few years.

Ironically, the Gree dehumidifiers were originally recommended by Consumer Reports, the popular consumer magazine that serves as an advocate for subscribers. The magazine routinely tests products acquired on its own dime in order to provide unbiased recommendations. As a result of the fires and initial recalls that have since been expanded, Consumer Reports actually delisted the product and recalled its own ratings.

In July 2012, MJC allegedly began receiving reports that dehumidifiers were overheating, igniting, and burning down homes. MJC allegedly forwarded these reports to Gree, which denied any problems and told MJC the products were fine. Nonetheless, complaints and reports of fires continued to pour in. MJC prudently refused to accept Gree’s denial of a problem. It hired an independent investigator who inspected exemplar dehumidifiers, including some involved in fires. The investigator allegedly confirmed MJC’s fears: the dehumidifiers contained a design defect that allowed the compressor to overheat which, in turn, caused the plastic dehumidifier to ignite.

Section 15 of the Consumer Product Safety Act requires that a manufacturer notify the CPSC immediately upon discovering potential substantial product hazards. MJC reported to the CPSC and issued a Stop Sale order to all of its retailers, a courageous decision in light of Gree’s denial of any problems with the product. In response, according to the lawsuit filed by MJC, Gree attempted to sabotage the Gree U.S.A. joint venture in which it was 51% owner, in order to bypass MJC and conduct business directly with joint venture retail partners. According to MJC’s lawsuit, Gree took aim at a contract with Sears by raising the prices of the units Gree U.S.A. was selling to Sears. Sears refused to pay the increased prices, effectively terminating the agreement. Gree then attempted to set up shady back room deals in which Gree would sell the units at a regular price to Sears, and then pocket the proceeds, circumventing Gree U.S.A. and MJC, according to the suit.

Once the relationship between Gree U.S.A. and Sears was destroyed, Gree allegedly halted production on all dehumidifiers. MJC had already transferred its largest accounts to Gree U.S.A. and thus was dependent on Gree’s continued manufacture of dehumidifiers. When Gree allegedly refused to make new units, MJC was unable to complete a large portion of confirmed orders for 2012.

On June 13, 2013, MJC filed a lawsuit against Gree in California federal court, seeking to recover damages resulting from the sabotaged joint venture. The very next day, MJC America sent a cease and desist letter to Gree, demanding that Gree stop putting MJC’s “Soleus Air” trademark on their appliances. Gree refused to comply with the cease and desist letter. After two years of litigation and a three-week trial, a California jury awarded MJC $42.5 million dollars, including $20 million in punitive damages. In the process, a mountain of damaging evidence against Gree became public record.

ENTER THE CPSC

Throughout the MJC litigation, the CPSC was investigating a possible recall of Gree dehumidifiers. On September 12, 2013, an initial recall was announced. The recall was expanded a month later, and again on January 30, 2014.

Throughout the MJC litigation, the CPSC was investigating a possible recall of Gree dehumidifiers. On September 12, 2013, an initial recall was announced. The recall was expanded a month later, and again on January 30, 2014.

On March 25, 2016, Gree agreed to pay to the CPSC a record fine of $15.45 million. In doing so, Gree refused to admit to the charges levied by the CPSC. Among the CPSC accusations against Gree was that Gree knowingly failed to report the dehumidifier defect, knowingly failed to report design changes Gree made to the dehumidifiers after discovering the defects, lied to the CPSC during its investigation, and the incredible claim that Gree had placed the Underwriters Laboratory (UL) logo on dehumidifiers indicating the products met UL flammability standards when, in fact, the marks were fraudulent.

Underwriters Laboratory is a safety consulting and certification company in the U.S. If you own a consumer electronic, it almost certainly is emblazoned with a UL symbol somewhere on its body, signifying that it has been tested up to and passed certain industry group safety standards. Most large U.S. retailers will not agree to put any product on its store shelves unless the product has been certified as UL compliant. According to CPSC allegations, Gree skipped the step of having its products actually tested by the UL but used the UL certification logo anyway.

In November 2016, the recall originally announced three years earlier, in September 2013, was re-issued, indicative of the dramatic dangers associated with the recalled dehumidifiers and the ineffectiveness of the initial recall effort (known as a corrective action plan or “CAP”).

At the time of the re-issued recall, Gree dehumidifiers and dehumidifier components were known to have been responsible for 2,000 incidents of dehumidifiers overheating, nearly 450 fires, and at least $20 million in known property damage. It is nothing short of a miracle that Gree dehumidifiers are not known to have caused any deaths to date.

INDIVIDUAL CLAIMS AND A CLASS ACTION

While dealing with the CPSC and MJC, Gree has also faced a steady stream of individual subrogation claims by insurers who paid large losses to insureds due to fires caused by Gree dehumidifiers. At this point, the entire insurance community and nearly all experts who investigate fires are on high alert anytime a fire investigation reveals a Gree-made dehumidifier in the vicinity of the area of origin. Gree signed indemnity contracts with the retailers who sold the affected dehumidifiers and the companies under whose brand names the products were sold. As such, Gree indemnifies and defends these entities anytime there is a lawsuit involving a Gree dehumidifier. To the author’s knowledge, no individual claim has yet to go to trial, because Gree (and its insurer, PICC) inevitably pays the loss so as to avoid an adverse verdict. Most often, suit need not even be filed. Gree’s apparent plan of action is to ultimately pay claims, though in doing so it often takes too long and attempts to low-ball its victims.

In 2017, a class action lawsuit was filed in California by several insurance companies. In Homesite Insurance Company of the Midwest v. Gree U.S.A., Inc., 2017 WL 2271121 (C.D. Ca. 2017), multiple insurance companies filed a class action lawsuit against Gree. The complaint alleges that Gree’s negligence caused fires in homes across the U.S. that caused damage insurance companies were forced to pay to remediate and, therefore, the insurers are entitled to subrogate against Gree.

The class action is still in its early stages and has already undergone one appellate trip to the 9th Circuit Court of Appeals. A motion to dismiss by Gree was denied by the court and, in true Gree fashion, the court order denying the motion ordered Gree’s lawyers to submit to the court, in writing, “why the court should not sanction them with a penalty of $500 for misrepresenting the law as it pertains to insurer’s rights to subrogate the rights of insureds.”

Gree’s mistakes have cost American homeowners and property insurance companies well over $30 million. These translate into subrogation opportunities which should not be ignored. There is also a lesson here for other manufacturers as to how not to respond to a product defect.

For questions on Gree dehumidifier fire subrogation claims or to discuss MWL representing your subrogation interests on one of these losses anywhere in the U.S., please contact Rich Schuster at rschuster@mwl-law.com.